NSSF Contribution Changes Effective from Feb-2026 (Web Payroll)

Important Note:

- This document is a guideline on how to update the New NSSF Contribution Rates from February 2026.

- Make Sure Previous Years & Months are closed before making these Changes

- After making these changes No Auto Calculation of previous Months should be done i.e., Prior Months.

Steps;

- Login into Paymaster with Administrative Rights

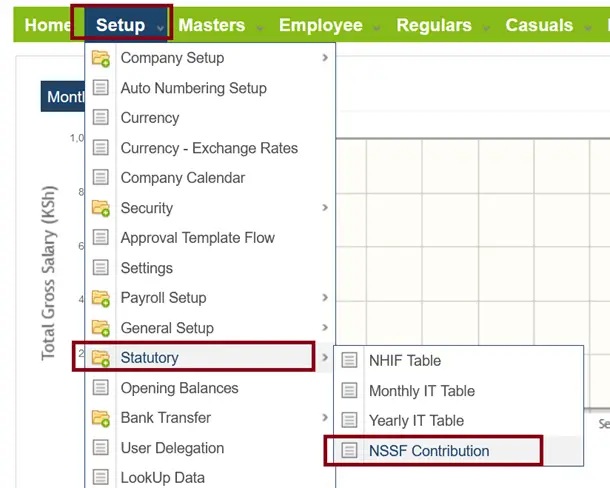

- Click Setup >> Statutory >> NSSF Contribution

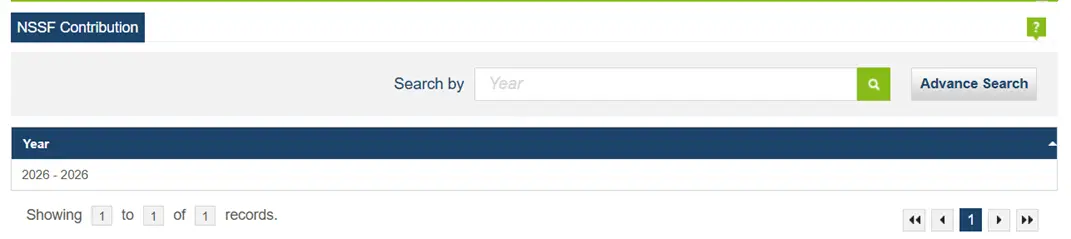

- It will Display Current Year NSSF Contribution Record

- Click on Year 2026-2026

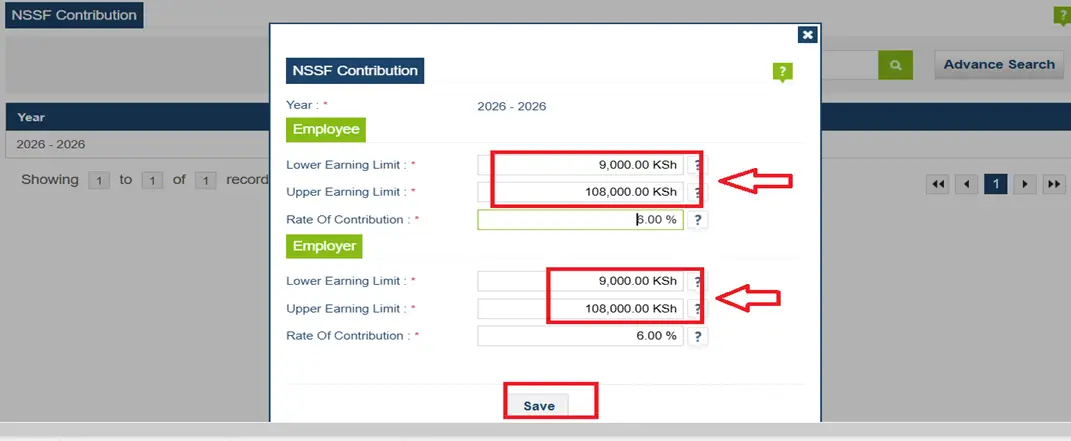

- On the screen which is displayed Set Lower Earning Limit to 9,000 and Upper Earning Limit to 108000 for Both Employee and Employer as indicated in following screen shot

- Click on Save

- Now you can Start Processing of Feb-2026 Payroll and verify the NSSF Contributions

Summary of this Changes:

Tier 1 Limit

- Increases from Ksh8,000 to Ksh9,000

- Employee contribution: 6% of Ksh9,000 Or Pensionable Salary whichever is Lower (i.e Maximum Ksh540)

- Employer contribution: 6% of Ksh9,000 Or Pensionable Salary whichever is Lower (i.e Maximum Ksh540)

Tier 2 Upper Limit

- Increases from Ksh72,000 to Ksh108,000

- Employee contribution: 6% of earnings above Ksh9,000, up to the new cap Kshs108,000

- Employer contribution: 6% of earnings above Ksh9,000, up to the new cap Kshs108,000

NB: If Assistance required, kindly get in touch with us on following support Lines

Telephonic Support : +254 709 970 000 (Type 1 On Voice Prompt)

Email Support : support.ke@endeavourafrica.com

Comments are closed